Group Policies

Key features of an international group medical insurance policy

Group Medical Insurance is a core benefit in the overall remuneration package for your senior management, particularly those in your international offices. It should be an investment strategy for implementing best practice from a human resource management point of view.

Below are key features of a group medical insurance policy that your business can offer as part of an employee benefits plan:-

Time

Value

Service

What are the typical benefits of an international medical policy?

These are some of the standard benefits included in an international medical insurance policy.

(*subject to change depending on your provider)

Inpatient Benefits

Hospitalizations in private or semi-private rooms

Inpatient Surgeries

Cancer Treatment

Transplant Services and Kidney dialysis

Diagnostic Procedures

Advanced Medical Imaging (MRI, CT, PET)

Organ Transplants

Ambulance Cover

Emergency Dental

Emergency Evacuation that includes travel costs

Medical Repatriation that includes Repatriation of Mortal Remains

Outpatient Benefits

Inpatient benefits plus the following

Consultations with GPs and Specialists

Outpatient Surgeries

Diagnostic Tests

Emergency Dental

Prescription Medication

Physiotherapy and Chiropractic Treatment

Complimentary Therapies such as Acupuncture, Osteopathy and Podiatry

Speech Therapists and Dieticians

Psychiatry and Psychotherapy

Why Choose Health Cover Now?

Health Cover Now will take the time to understand your specific needs and guide you through a process that ensures you get the best possible cover at a price that meets your budget. We have the knowledge and experience to advise group clients no matter your size or needs.

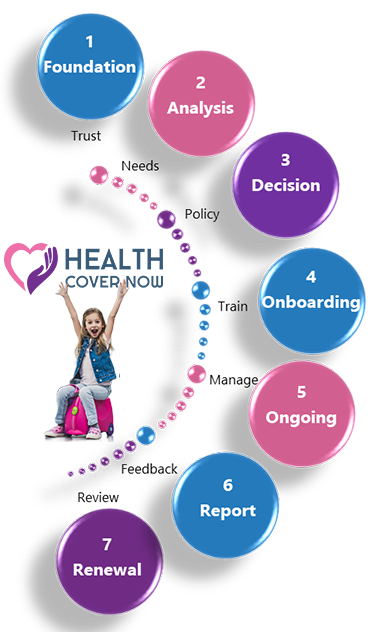

A typical Customer Journey:-

1. Foundation

Establish trust and get to know you as a client

2. Analysis

Understand your needs, compare different options

3. Decision

Policy selection, and implementation planning

4. Onboarding

Training and induction for administrators/employees

5. Ongoing

Support for hospitalizations, claims and emergencies

6. Report

Trend analysis and management reporting

7. Renewal

Benchmarking and policy adjustment

When acquiring a group medical policy, you must examine several criteria to guarantee that your policy not only meets your budget but also satisfies your needs relating to:-

Its important to consider whether you qualify for a policy that covers pre-existing conditions under special terms with medical history disregarded policy.

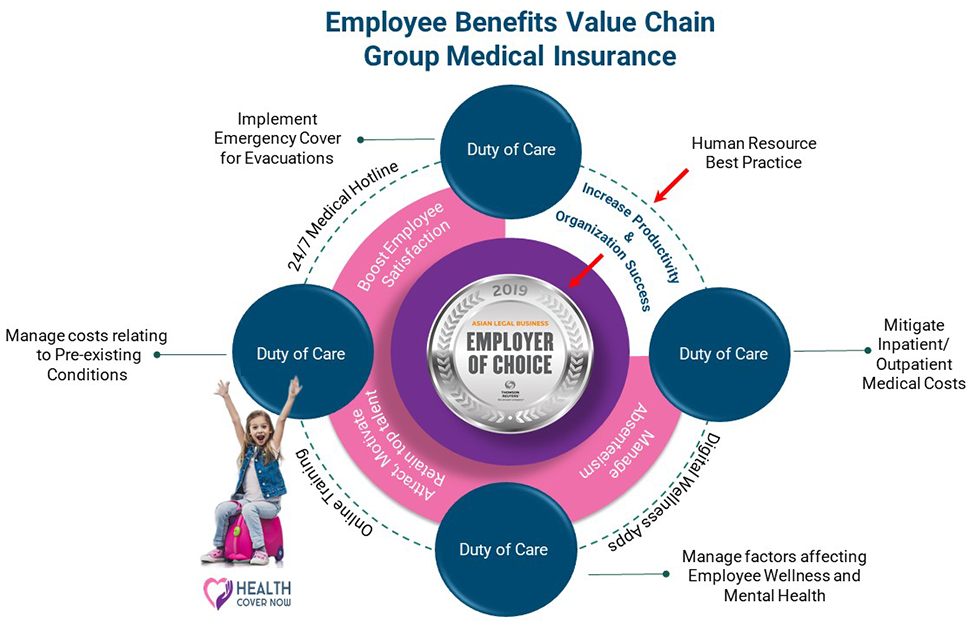

Why do companies purchase International Medical Insurance?

As an employer of choice, companies purchase foreign health insurance to meet their duty of care obligations, effectively manage employee-related health care expenses, and attract, retain and motivate top talent globally. Additionally, a group medical policy can be used to reduce absenteeism and enhance employee satisfaction.

An international group medical policy will directly cover costs relating to :-

Your employees, specifically your senior management, drive your business growth and are crucial to your overall business success.

Become an employer of choice and reduce the gap between employee expectations and market best practices by implementing a group insurance policy today.

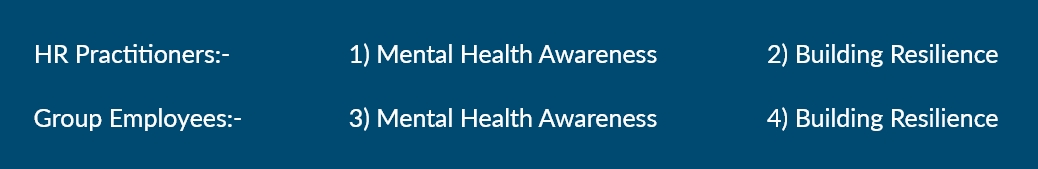

Employee Wellbeing Programs for Staff and Managers

Health Cover Now is one of the only brokers on the market that offers mental health, well-being, and lifestyle training programs to its group clients. We provide a range of digital initiatives we have developed with key industry partners who specialize in this space. These can either be off-the-shelf or bespoke programs depending on your specific needs.

Programs that we offer :-

We also work with our insurance partners to support group clients by implementing well-being programs for their employees that improve awareness and drive healthy living outcomes. These include employee assistance programs and digital wellness resources.

Build a more resilient and robust workforce by improving the health and well-being of your employees.

As an HR professional it is important to be aware of the specific risks associated with the secondment of employees to your international offices and operations. It is critical that your senior management understands that your business not only has an increased moral responsibility towards your employees but also a legal one. Legal liability is not limited to the country that your employees are seconded to but is extended to their home countries.

Moving into to new markets will expose your business and its people to increased risks from a health, safety, and security perspective. There is a minimum Duty of Care that needs to be considered to ensure your employees, and their families, have adequate cover for costs associated with everyday health concerns and those related to unexpected accidents.

As a business you will need to consider a group medical policy that covers employees for both inpatient and outpatient medical costs. It’s important your employees have the freedom of choice to access medical care of an international standard that they would typically enjoy in their home country. A policy that supports healthy living and wellbeing initiatives will go one step further and extend your duty of care beyond simply managing health related costs.

A good group medical insurance policy not only helps manage these risks but also allows your company to meet its Duty of Care and legal obligations associated with sending employees overseas. There is legal precedent associated with Duty of Care and it has become common place for organizations to consider this as standard practice prior to assigning their employees to overseas offices.

Health Cover Now has many years of experience in advising companies on their obligations relating to international medical insurance and employee benefit strategies to help mitigate risks associated with assigning employees overseas. Speak to us today to learn more about specific Duty of Care compliance in your country and the type of policy you need to implement.